Yikes! It's that Bad?

The 1040 tax instruction publication lays it all out

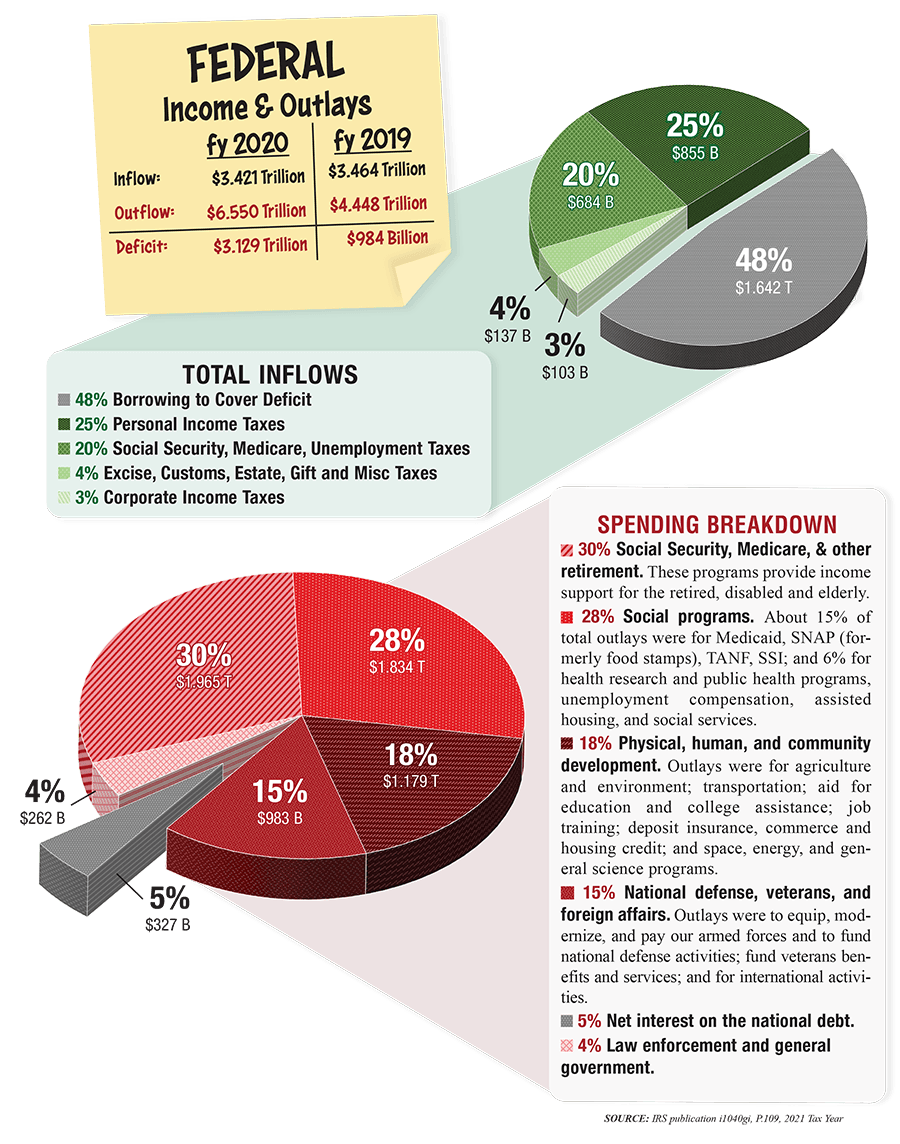

Any way you look at it, the federal government's spending habits are a big mess. As required by law, in every Form 1040 instruction booklet there's a section that shows where our federal government gets its money and where it is spent. As taxpayers, it makes sense to know this information. Here is the data for the government's fiscal year ending September 30, 2020, as reported by the IRS in the 2021 instruction booklet for Form 1040:

Observations

- Deficit spending balloons to $3 trillion for one year and is not sustainable. No matter where you fall on the political spectrum, annual deficits of $3 trillion cannot be sustained. Much of this increase is due to multiple stimulus payments, tax-free small business loans, and increases in credits like the child tax credit.

- Government borrowing hurts savers. In 1990, $50,000 worth of Certificates of Deposits (CDs) earned 8% interest, or $4,164, each year. Today, that same $50,000 earns just 0.6%, or $301. What happened to the other $3,863? Your interest income is now helping to cover money borrowed by the government in the form of lower interest rates. Look at 2020...almost half of the money inflows received by the federal government was borrowed!

- Low interest expense risk. Look at the percentage of money spent on interest expense in 2020. It’s at 5% with interest rates hovering around zero. So what happens when rates start to increase? As a percentage of overall expenditures, interest expense could triple to 15% of spending...and potentially go even higher than that.

- Solutions to money problems are the same for everyone. When you have a money problem, you either bring in more money, spend less, or some combination of the two. The same is true for our federal government.

Make a difference!

Spending more than you bring in will cause big problems...eventually. Money doesn’t just magically appear on printing presses. That money has to come from someplace and that someplace is from everyone. It is not a hopeless situation, however. Make your voice heard...it’s your money!

Visit our Tax Planning page for more information.