Blog Layout

Warning! IRS Announces NEW 2022 Mileage Rates.

Tax Resolution Accounting • July 5, 2022

IRS Announces NEW 2022 Mileage Rates

New rates begin in July

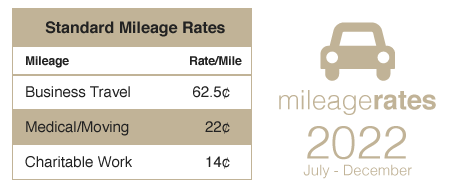

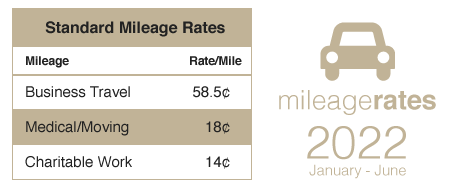

In a recent announcement, the IRS raised the standard mileage rates for travel beginning in July, 2022. Use the previously announced mileage rates for qualified travel in the first half of the year. Use the revised rates for travel in the second half of 2022.

NEW Mileage rates for JULY through DECEMBER 2022

2022 Mileage Rates JANUARY through JUNE

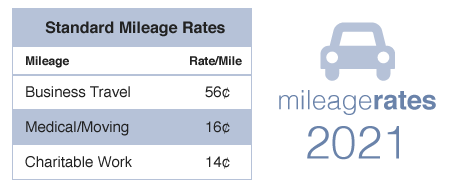

Here are the 2021 mileage rates for your reference.

2021 Mileage Rates

Remember to properly document your mileage to receive full credit for your miles driven.

Visit our Tax Planning page for more information.

By Justin Henderson

•

March 4, 2025

Facing IRS tax issues? Let Tax Resolution Accounting help you find effective solutions with expert tax planning, debt resolution, and financial guidance. Our team offers personalized tax services to lift the burden off your shoulders. Plus, take advantage of our referral bonus program - earn credits when you refer others to experience the same trusted service. Contact us today to get started on resolving your tax concerns and securing a brighter financial future.

By Justin Henderson

•

February 25, 2025

Cryptocurrency has moved from the fringes of finance to the mainstream, and with that shift comes increasing scrutiny from tax authorities. The IRS has made it clear: digital assets are not exempt from tax laws. Whether you’re trading Bitcoin, earning yield on DeFi platforms, or getting paid in crypto, you must report your transactions correctly—or risk facing penalties. With enhanced IRS reporting requirements on the horizon, now is the time to get your crypto tax house in order. At Tax Resolution Accounting, we’re here to help you navigate these changes with confidence and peace of mind.

© 2025

Tax Resolution Accounting

500 Stuart St, Lynchburg, VA 24501